By Ben Crabb, Regional Economist

Every summer, the ranks of the Utah workforce swell with teenage workers taking up summer jobs. This year, teenage labor is especially valued by employers trying to fill open positions in the midst of historically low unemployment rates and strong job growth. In fact, teens have seen their wages rise faster than any other age cohort, making this a great time for Utah’s youngest workers to find gainful employment.

This article will explore aspects of Utah’s teen workforce, including Utah’s uniquely young demographics, teen labor force participation rates, reliance of various industries on teen workers, and wage gains by age groups.

The information that follows comes from a variety of data sources, therefore teen age groupings can vary slightly from one graph to the next. For example, 14-18 is the teen age grouping in the “Quarterly Workforce Indicators” from the Census Bureau’s LEHD program, while the Census Bureau’s American Community Survey segments teens into a 16-19 age group. Despite these differences, the age groupings have substantial overlap, and insights provided about the teen workforce should be generally, if not directly, comparable.

Youthful Utah

With high fertility rates and larger-than-average family sizes, Utah consistently has a larger share of the working age (age 16+) population being teens compared to other states. Indeed, Utah is the youngest state in the country by this metric:

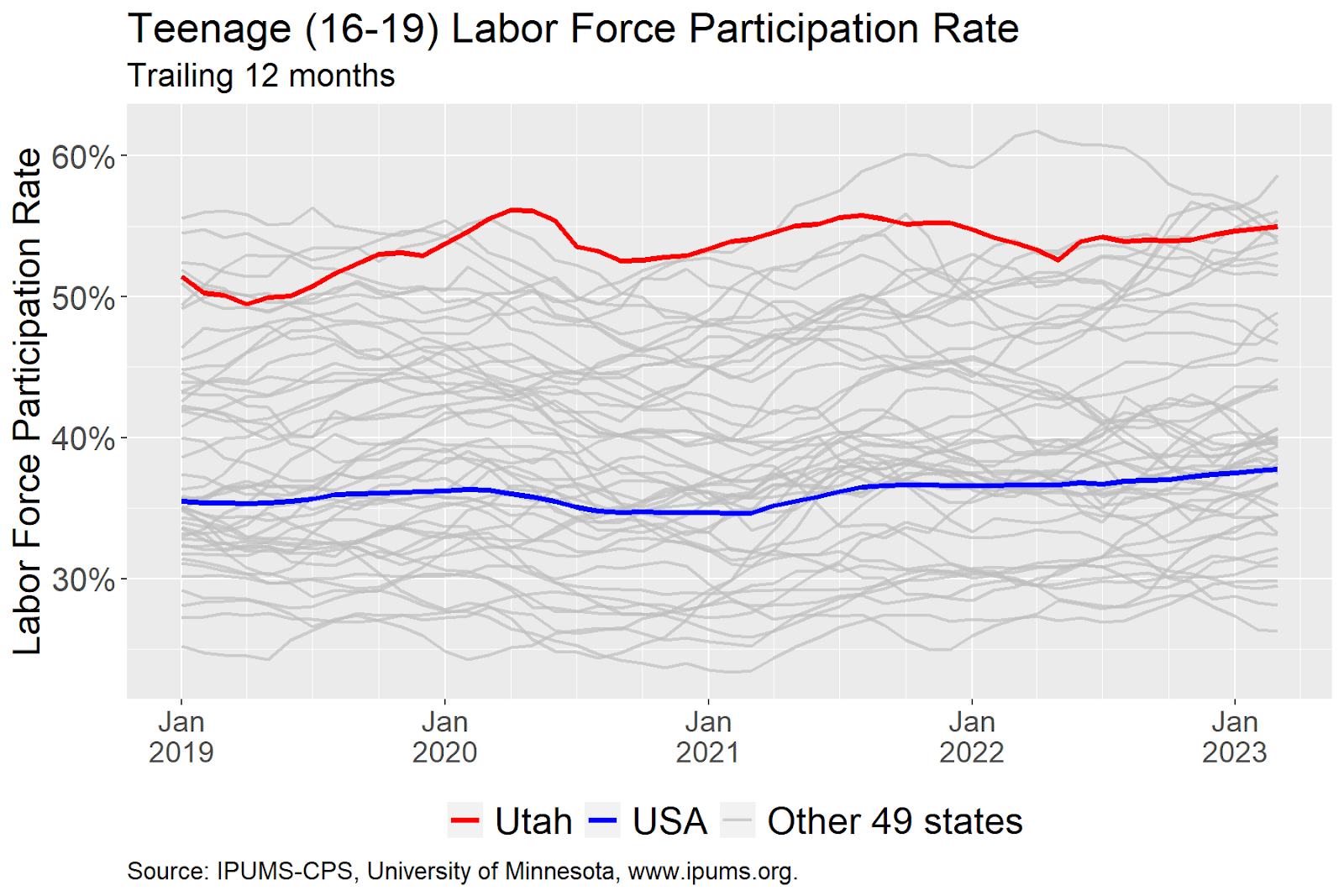

Utah’s state motto is “Industry,” and the Beehive State puts a high value on work. So not only does Utah have a younger population than other states, its teens are also more likely than teens in other states to be active participants in the labor force – that is, they are either working or looking for work. For the twelve months ending in March 2023, Utah ranked fourth in the nation in teenage labor force participation at 55%, trailing only Iowa (58.7%), Nebraska (56%), and Minnesota (55.5%).

While Utah’s teens exhibit high rates of labor force participation compared to their counterparts in other states, Utah’s teen girls tend to have a slightly higher level of labor force participation than teen boys. The difference is not dramatic. Girls’ labor force participation is usually just a few percentage points higher than boys’, but it is pretty consistent across time.

A recent exception to this trend was during the peak of COVID restrictions, when the pandemic pushed teen labor force participation down in 2020 and 2021. During this period, teen girls’ labor force participation had a larger decline than did the boys’ rate. This is imaginable because girls are more likely to work in jobs that feature more face-to-face customer interaction where COVID restrictions were more acute. So for a brief period, teen male labor force participation exceeded teen female rates. However, once pandemic restrictions eased, girls’ labor force participation outperformance quickly re-emerged.

Where are all these teens working?

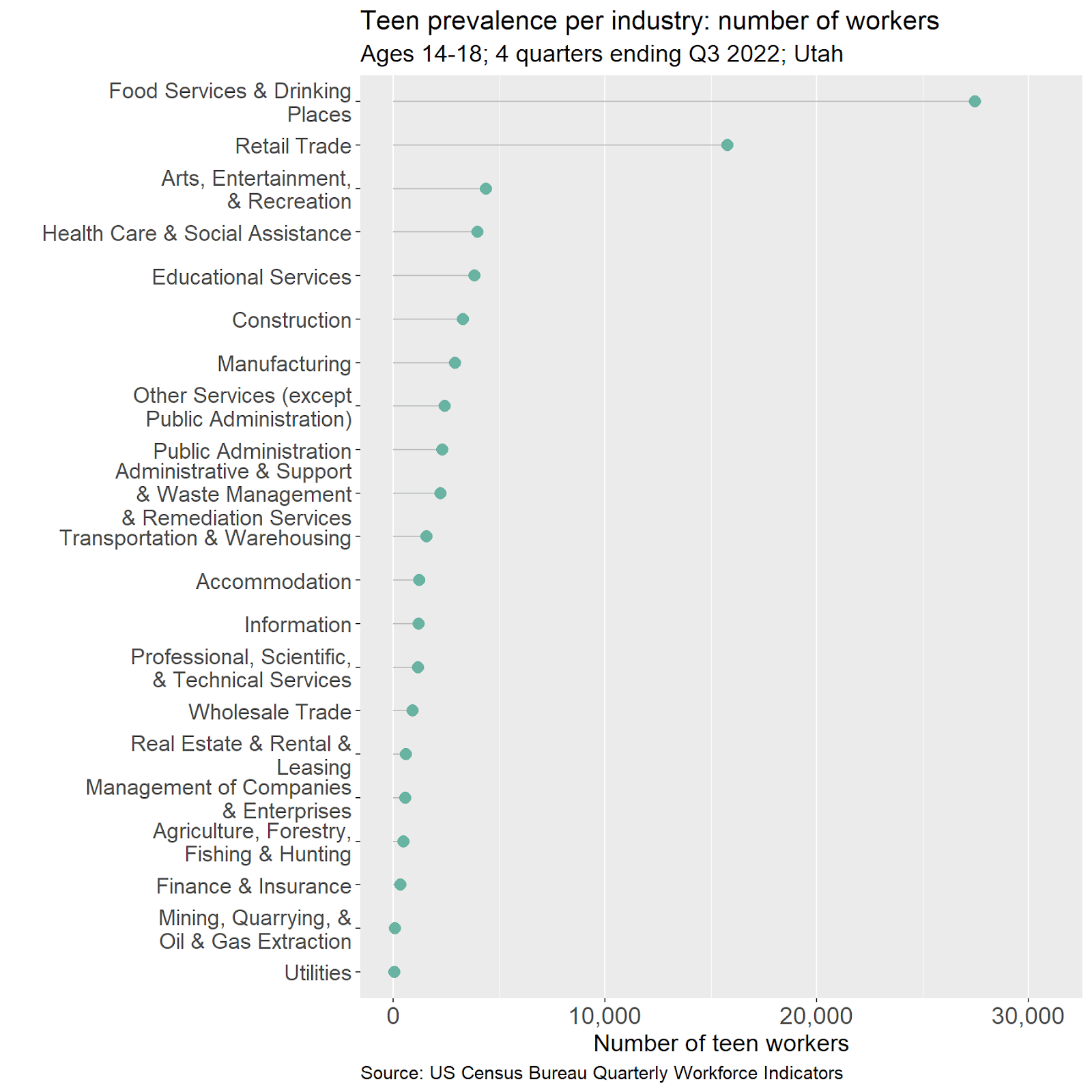

Teen employment in Utah is dominated by two industry groups: food services and retail trade. Around 27,000 teens work in food services (i.e. restaurants) in Utah, and another 16,000 work in retail establishments across the state. These are unsurprising insights, as teen workers are common sights at fast food establishments, food stands, other restaurants, grocery stores, and convenience stores.

Other industries that employ notable numbers of teen workers, though at far lower total levels than restaurants and retail, include arts, entertainment and recreation; health care and social assistance; educational services; construction; and manufacturing.

Comparing teen employment levels to total jobs in each industry provides a measure of how much each industry depends on its teenage workforce. Expressed as a share of all workers, the importance of teen workers to restaurants, and the arts, entertainment and recreation industry is obvious. Fully a quarter of all food service workers are 14 to 18 years old, and in the arts, entertainment and recreation industry, teens make up about 13% of the workforce, or about 1 in 8 employees.

The seasonal labor needs of these industries helps enhance the compatibility with the teen workforce, as labor is in highest demand during the summer months when school is not in session. The other industry with a large number of teen workers, retail trade, has a smaller share of the workforce comprised of teens (9%) due to the sheer size of that industry.

The dependence of the two biggest industries on teenage workers has been super-charged in the post-pandemic economy. Labor shortages across industries attracted older workers to higher paying jobs in other industries and made employers in food services and retail trade extra dependent on employing teens.

Teen wages: up and up

With all of this need for and dependence upon teen workers, teen-worker wages have gone up substantially. While the tight labor market has driven up wages for all age groups, Utah’s youngest workers have seen higher wage growth (in percentage terms) than other groups. In early 2023, teen wages were up nearly 40% over 2019 levels, compared to around 15% wage gains in older age groups.

When labor becomes in short supply, the general demand for all labor segments, high skill to low skill, increases. Labor is largely segmented by its skill sets through wages or the cost for businesses to hire skill sets. In such a labor-shortage environment, labor migrates up the skill/wage scale. Businesses are willing to train workers and pull them up the skill/wage scale. The end product is that the lowest end of the labor-skill arena is where the largest shortfall of labor will eventually exist. The in-place labor pool has migrated up and out of this lowest-skill arena. Therefore, the lowest-skill arena then becomes the area with the least amount of available workers. The market economy’s way to fill this void is to offer higher wages for even the lowest-skilled labor. This then is why teen labor is at its highest demand in decades, and why the teen wage-scale is rising at a higher rate than all other skill-set wage scales.

With these robust wage gains, it is the rare teen who is earning the state’s minimum wage of $7.25/hour. Average wages for 16 and 17-year-olds in early 2023 were around $13/hour, while 18 and 19-year-olds were earning an average wage of around $15/hour.

Teen wages: How does Utah stack up?

With teen wages rising rapidly in Utah, the state has climbed the rank of states with high teen wages. While teen wages here have typically been below the national average, recently Utah’s average teenage wage has met and even exceeded the national average. Despite the state’s minimum wage of $7.25/hour, Utah is now among the states with relatively high average wages for teen workers.

Final thoughts

Despite concerns over the last year or two about a potential approaching recession, Utah’s economy continues to expand its employment base and increase wages. Tight labor markets across the state have helped workers of all ages enjoy substantial wage gains in recent years. With labor in high demand and short supply, teens in particular are enjoying outsized gains in their earnings potential.

For teens, the current labor market is highly conducive to landing an entry level job, affording the opportunity to gain experience in the workforce and earn money at relatively high hourly wages.

For employers looking to hire young workers, the wage gains of recent years means that offering wages in the $12-15/hour range are likely necessary to fill entry level job openings.

It seems that the days of teens toiling for minimum wage are, for now, a thing of the past.